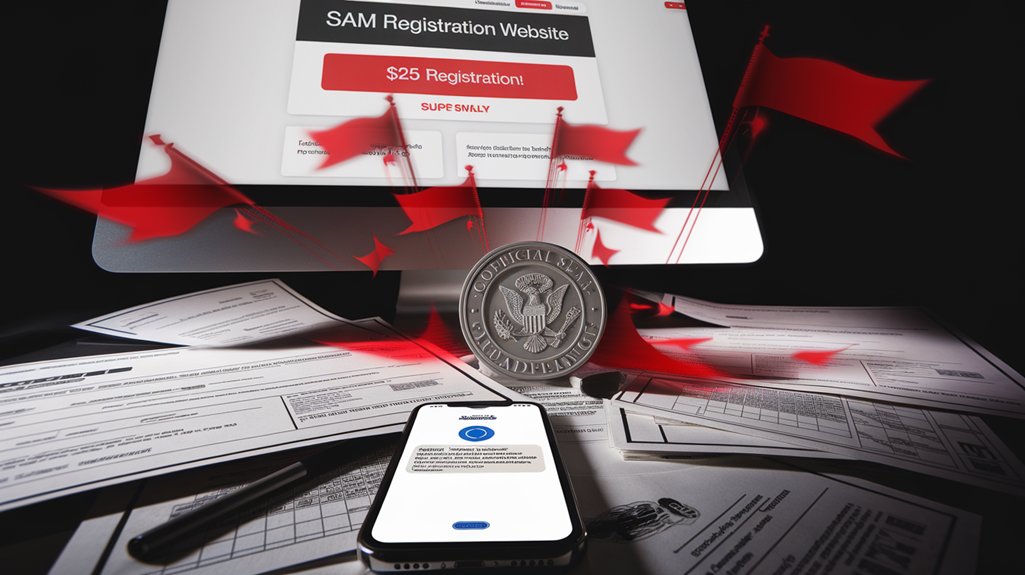

Red flags for low-cost SAM registration services include false urgency claims, requests for sensitive financial information via email, and promises of expedited processing. Legitimate SAM registration is always free through the official SAM.gov website, while third-party services often lack proper security protocols. Companies should verify sender addresses, implement two-factor authentication, and train employees to recognize phishing attempts. Small businesses and nonprofits are particularly vulnerable to these deceptive tactics. The following sections explore protection strategies and cost implications.

Recognizing Deceptive Registration Tactics

While traversing the System for Award Management (SAM) registration process, businesses must remain vigilant against fraudulent schemes designed to exploit their need for compliance.

Effective scam identification begins with recognizing communications that create false urgency. Data accuracy requirements make it crucial to work only with legitimate registration services. Legitimate government correspondence never employs pressure tactics or threatens penalties for immediate non-compliance.

Government agencies communicate without urgency tactics or immediate penalty threats. Recognize this distinction to identify SAM registration scams.

Registration scams frequently manifest as official-looking emails containing company-specific information, claiming SAM registrations are expiring or incomplete. These deceptive messages typically include links to counterfeit websites lacking proper security protocols like HTTPS. Small businesses and nonprofits are frequent targets due to their unfamiliarity with federal registration procedures.

Similarly, unsolicited phone calls offering expedited registration services for a fee represent another common tactic.

Always verify email domains carefully, as communications from non-government domains rather than .gov addresses are clear indicators of potential scams.

To protect your business, verify all SAM-related information directly through SAM.gov rather than through links in emails, and remember that complete profiles aren’t mandatory for registration.

Financial and Security Risks of Bargain SAM Services

Despite their appealing price points, low-cost SAM registration services present substantial financial and security risks that can jeopardize a company’s federal contracting eligibility.

Companies experiencing data validation issues often face extended processing delays that can impact their ability to bid on contracts. Historical breaches have exposed contractors’ banking information, leading to fraudulent payment diversions and significant financial losses.

Effective fraud prevention requires robust security protocols that budget services often neglect. Contractors who unknowingly use compromised third-party accounts face direct financial consequences when payments are intercepted. A recent GAO decision highlighted how even temporary SAM registration lapses can disqualify contractors from receiving federal contract awards. FAR 52.204-7 mandates that contractors maintain active registration throughout the entire contract evaluation and performance period.

The cost implications extend beyond the initial registration fee, potentially including:

- Lost contract opportunities due to registration suspension

- Recovery expenses from payment diversions

- Legal costs from liability for third-party errors

- Cash flow disruptions when government payments are delayed

Bargain services frequently lack encryption or verification systems necessary to protect sensitive financial data, making them attractive targets for scammers.

Protecting Your Business From SAM.Gov Fraud

As government contractors face increasing threats from sophisticated scammers, implementing robust protection measures for SAM.gov accounts has become essential for business survival.

Protecting your business identity requires vigilant monitoring of all SAM.gov communications and account activities.

Effective fraud prevention strategies include:

- Verify all emails claiming to be from SAM.gov by checking sender addresses carefully

- Update SAM registrations only through the official website

- Implement two-factor authentication for all account access

- Train employees to recognize phishing attempts targeting procurement information

- Review registration details monthly for unauthorized changes

When suspicious activity occurs, document all evidence and contact the SAM helpdesk immediately.

Remember that legitimate SAM.gov representatives never request sensitive financial information via email or unsolicited phone calls.

Nonprofit organizations may qualify for fee waivers to reduce administrative costs and focus on their missions.

Maintain at least two SAM Administrators for your company to ensure continuous secure access and verification capability.

The registration process for SAM.gov is always free, including technical support, so be suspicious of any service demanding payment for assistance.

Frequently Asked Questions

How Long Does a Legitimate SAM Registration Typically Take?

A legitimate SAM registration typically takes between 2 to 8 weeks to complete, depending on several factors affecting the registration efficiency.

The SAM registration timeline can extend to 10 weeks during high-volume periods or when technical issues arise.

The process includes initial registration (45 minutes), submission of a notarized letter, and a validation process lasting 6-8 weeks.

Business complexity, information accuracy, and proper documentation preparation are key factors that influence completion time.

Can Third-Party Registration Services Ever Be Legitimate?

Yes, third-party registration services can be legitimate. Many firms offer valuable expertise for steering through complex government processes, especially for businesses unfamiliar with federal contracting requirements.

However, businesses should be aware of registration risks, including potential overcharging and data security concerns.

Legitimate services transparently disclose their non-government status, provide clear fee structures, maintain verifiable business credentials, and never pressure clients with urgent payment demands or false deadlines.

What Documentation Do I Need Before Starting SAM Registration?

Before starting the registration process, organizations should gather these essential documents:

- Taxpayer Identification Number or EIN

- Legal business name matching IRS records

- Physical address information

- Banking details for payment processing

- Notarized letter authorizing registration

- Business structure documentation (articles of incorporation, etc.)

- Classification codes information

Having these documents prepared in advance will streamline the SAM registration process and prevent potential delays.

How Can I Verify if My SAM Registration Is Actually Active?

To verify if a SAM registration is active, users can employ several verification methods:

- Use the “Check Entity Status” tool on SAM.gov by entering the UEI or CAGE Code.

- Navigate to the “Search Records” function on SAM.gov.

- Check the confirmation email received after registration, which includes the registration status.

- Log into the SAM.gov account to view the current status and expiration date.

The registration status should display as “Active” when properly validated.

What Steps Should I Take if I’ve Already Paid a Scammer?

When someone has paid a scammer, immediate action is necessary.

They should cease all communication with the scammer and secure their accounts by changing passwords.

For recovery options, they should contact their financial institution to dispute charges and file reports with the FTC at ReportFraud.ftc.gov.

Reporting scams to local law enforcement and the state attorney general helps authorities track these activities.

Implementing preventive measures like credit monitoring can protect against future fraud.